They determine specific pivot points or central pivots that define a sort of equilibrium point or a neutral market.

Floor trader pivots formula.

Pivot points are also know as floor trader pivots or pivots or floor pivots or session pivots.

There are two main ways to trade pivot levels harrison 2011.

Floor trader pivot calculator calculate pivot levels for any trading instrument.

The pivots can be.

Calculate floor trader pivots.

Central pivot high low close 3.

Trade with floor trader pivots support and resistance.

These are the places where traders expect support and resistance to occur in the market and as such are used as entry and exit points for trades.

The formula uses the previous day s high low and close to calculate the central pivot neutral area for the market.

With so many large traders keying off of these levels they can become a self fulfilling prophecy.

The floor pivot points are the most basic and popular type of pivots.

Generally these values are derived from the e mini s p futures also known as es.

The name floor trader pivots comes from a time before online trading where floor trader s needed an easy formula to determine whether a price was relatively cheap or expensive before.

What are floor trader pivots.

Below are the calculations for the floor trader pivots that are sometimes used in the broadcast and are listed daily in the shadowtrader pro swing trader.

The high low and close used in the calculation is from the prior day s values.

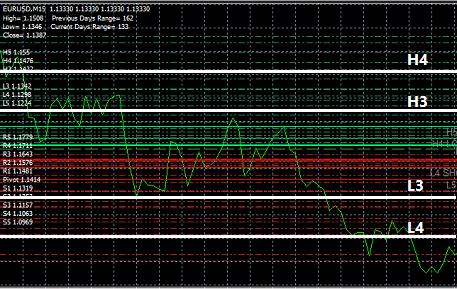

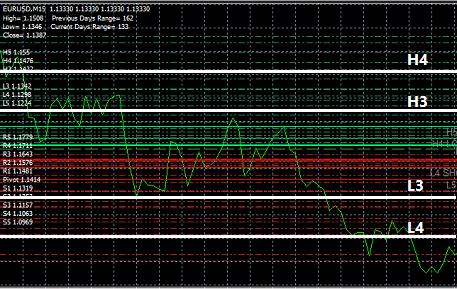

So based on the main pp level the floor trader pivots identify three support levels s1 s2 and s3 and three resistance levels r1 r2 and r3.

The pivot points calculation for trading is more useful when you pick time frames that have the highest volume and most liquidity.

Floor traders and other professionals who do the actual buying and selling of futures contracts in the trading pits of the exchanges generally employ very similar systems for valuing the price of these instruments in.

Floor trader pivots are often called calculated pivots because they are determined through a series of calculations using numbers from previous days.

Types of pivots.

A calculated pivot often called a floor trader pivot is derived from a formula using the previous day s high low and closing price the result is a focal price level about.

The most popular method for calculating floor trader pivots is the original formula.

Pivot system support and resistance explained.

Each day floor traders use a formula to calculate what might be the pivot points for the day s trading.

But how can we use these levels in our trading.